The Next Big Short: Hidden Risks Behind Private Equity's $8 Trillion Market

"Private equity is the biggest bubble in the history of bubbles." —Jared Dillian

AT A GLANCE:

The global private equity market has experienced explosive growth from $579 billion in 2000 to over $8 trillion today.

Much like the growth and financial engineering that fueled the mid-2000s mortgage bubble, we've hit peak levels in the private equity cycle. An unwinding is imminent.

-

The Next Big Short exposes the hidden risks of private equity and private credit that are threatening financial stability.

As the private equity bubble unwinds, investors can now position themselves to protect their wealth and potentially profit from a market shift on par with the Global Financial Crisis.

Editor's Note: Throughout this white paper, "Private Equity" will often be referred to as "PE" and both terms will be used interchangeably, at my discretion.

Table of Contents

Chapter 1... The Explosive Growth of Private Equity

Chapter 2... Deals Vanish and Volume Declines

Chapter 3... Cracks in the "Buzziest" Corner of Wall Street—Private Credit

Chapter 4... Pension Fund Problems

Chapter 5... Sentiment Extremes

Chapter 1: The Explosive Growth of Private Equity

- The Rise of Private Equity

- Longer Hold Times: A Symptom of Distress

- And More

The Rise of Private Equity

Private equity has exploded in popularity since the beginning of the 2010s during periods of low interest rates.

In 1980, there were 24 PE funds.1 By 2015, this number had increased to approximately 6,600. By 2022, there were 17,0002 private equity firms in the United States.

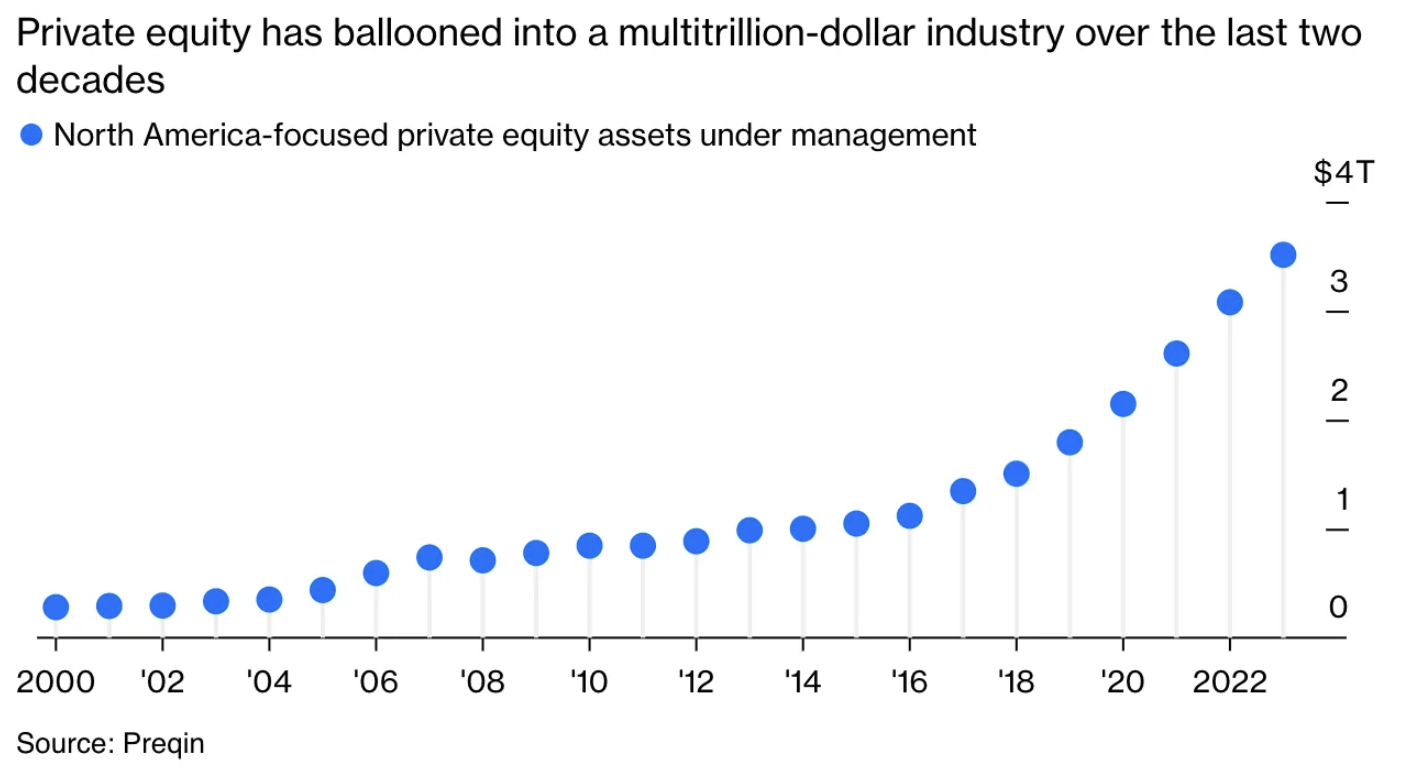

The growth of assets under management (AUM) in private equity has been equally impressive. In 2000, PE firms collectively managed $579 billion. By 2022, this figure surged to about $7.8 trillion.

In North America, the PE industry ballooned to $4 trillion.

Two of the bigger PE firms worth mentioning:

KKR: Started in 2005 managing $15 billion in AUM. Today, it manages $575 billion, a 3,733% increase.3

Blackstone: Started in 1985 with $400,000 and now manages over $1 trillion.

The rapid pace of this astonishing growth is eerily reminiscent of the rise of mortgage-backed securities in the mid-2000s…

Which is exactly why you should care.

Let's take a step back and remember the cause of the Great Financial Crisis (GFC) in 2008.

Real estate, specifically the mortgage market, was the epicenter.

The shenanigans in the mortgage market and the subsequent collapse of real estate prices led to a global recession.

By 2006, the mortgage industry represented a significant portion of the economy—mortgage debt of US households reached 97% of GDP, and 40% of net private-sector job creation between 2001 and 2005 was in housing-related sectors.

Yet its collapse nearly brought down the entire global financial system.

Millions of people were affected, with devastating losses across the board.

In the United States, the stock market plummeted, wiping out nearly $8 trillion in value between late 2007 and 2009.

Unemployment climbed, peaking at 10% in October 2009.

And between October 2008 and April 2009, an average of 700,000 American workers lost their jobs each month.

The stock market crash wiped out billions in retirement savings, and it took years for the economy to recover.

Many of the biggest banks and insurance companies had to be bailed out, while others collapsed under the weight of their bad investments.

Governments slashed interest rates and flooded their economies with cash in a desperate effort to save the world as we know it.

The Dow Jones Industrial Average and the S&P 500 lost more than 50% of their value, and it wasn't until March 2013 that they fully recovered.

Americans lost $9.8 trillion in wealth as their home values plummeted and their retirement accounts vaporized—some investors never fully recovered.

Today, the private equity market is a dominant force in the economy, mirroring that of real estate and mortgages before the GFC.

The private equity industry and private-equity-backed companies directly employ more than 11.7 million workers in the United States… roughly the population of Ohio.

In 2020, private equity was credited for generating $1.4 trillion of gross domestic product (GDP), or about 6.5% of total GDP.

You might think, "I'm not a private equity investor, so why should I care?"

Remember that during the GFC, not many people knew what a mortgage-backed security was, or negative amortization, or the risks of an adjustable-rate mortgage.

But the few investors who saw the collapse coming were able to position themselves to not only protect their wealth but also become fabulously wealthy within a short time.

The same opportunity could be on the horizon with private equity.

So, while the rise of KKR, Blackstone, and others may seem impressive, it's important to realize that history might be repeating itself—this time with private equity at the center.

If you are going to a restaurant, a car wash, or a dentist's office, there is a good chance that it is owned by private equity.

And you have probably noticed that service has deteriorated, and prices have increased.

The reason is that there is a mismatch in priorities between the founder of a business and the private equity owner of a business. The founder of a business thinks long-term : How do I please customers and keep them coming back? A private equity owner only thinks about short-term profitability: How do I extract the most value out of each customer and transaction?

Also, once a private equity owner has extracted all the value possible out of the business, he doesn't care if it goes bankrupt. But a founder cares and will do whatever it takes to stay in business. A founder will keep employees around for morale or other intangible reasons—a private equity owner will fire them remorselessly.

It is this mismatch in priorities between the founders and the PE owners they sell to that creates most of the problems we are experiencing.

Due to this alarming growth, finding new deal flow has become problematic. There simply aren't enough available companies to roll up.

As a result, PE firms have been forced into downgrade markets and are acquiring less-than-ideal businesses that have lower margins and less growth potential compared to more traditional high-return investments.

Examples of downgraded markets include recent acquisitions in digital comics4, smoothie shops5, bakeries6, car washes7, and laundromats.8

Longer Hold Times: A Symptom of Distress

Private equity companies need quick turnaround times to meet investor demand, free up cash, and expand their businesses. Their goal is to buy an underperforming business with stable cash flows, make it more efficient, turn it around, and sell it at a higher valuation.

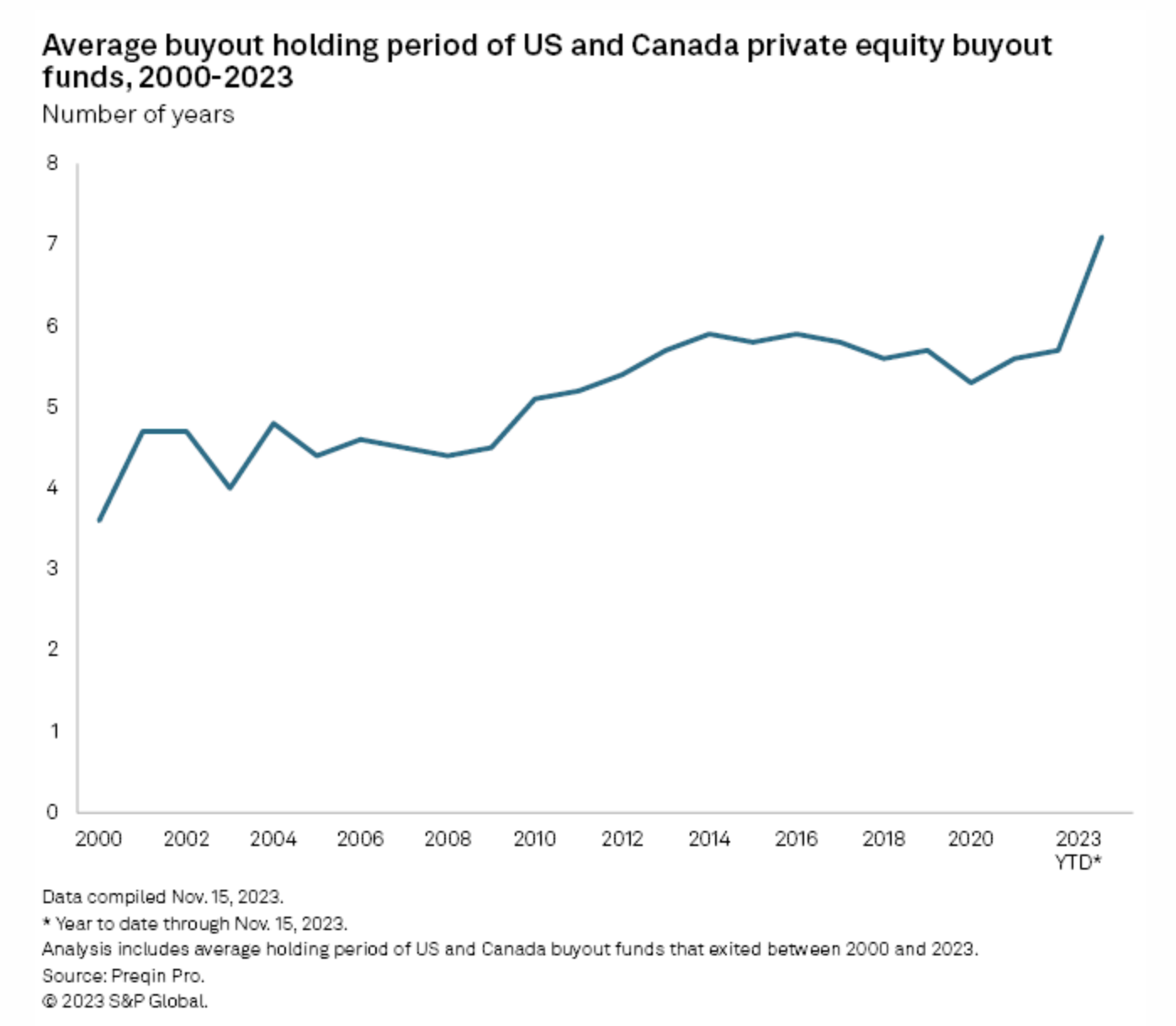

Typically, they hold onto portfolio companies for an average period of three to five years9, although sometimes longer.

But due to economic conditions in recent years, the median holding period has lengthened to nearly six years.10

In 2023, the number of companies held for five years or more increased by 18% year over year.11

Also, companies held for four years or more made up 46% of the total, the highest level since 2012.12

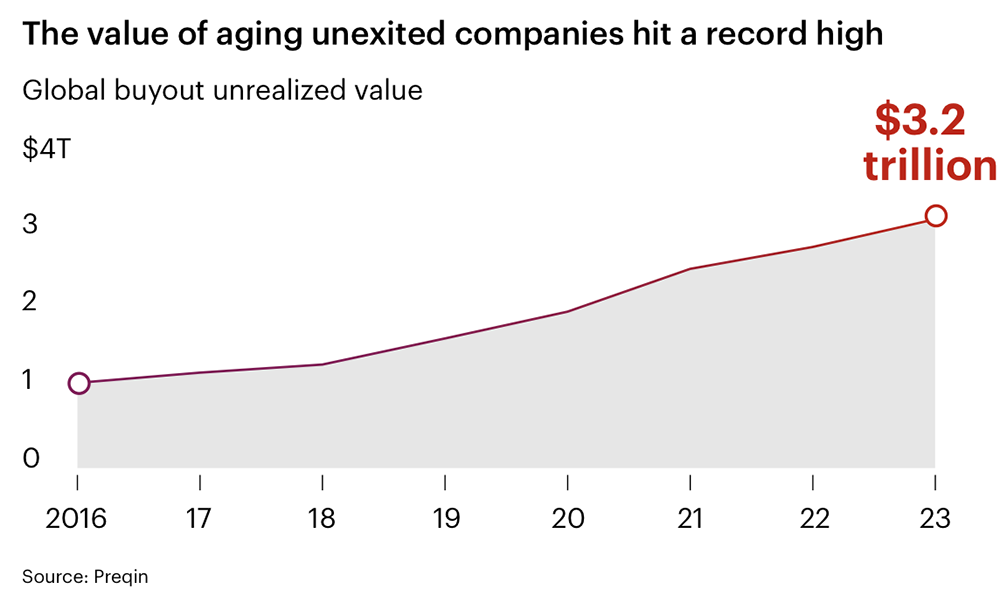

Portfolio companies are being held for a record amount of time as private equity firms are struggling to exit their investments creating a bottleneck in the PE lifecycle. If PE firms can't exit, they can't return cash to their investors (called "limited partners"), then the limited partners get upset and threaten to redeem their shares.

This raises questions about the future stability of the industry and its ability to continue delivering expected returns since private equity portfolio companies are being held for record amounts of time.

The longer companies are held by firms, the lower actual returns go.

For many years, private equity firms delivered double-digit growth with limited volatility, exactly what you are looking for if you are a pension fund or an endowment.

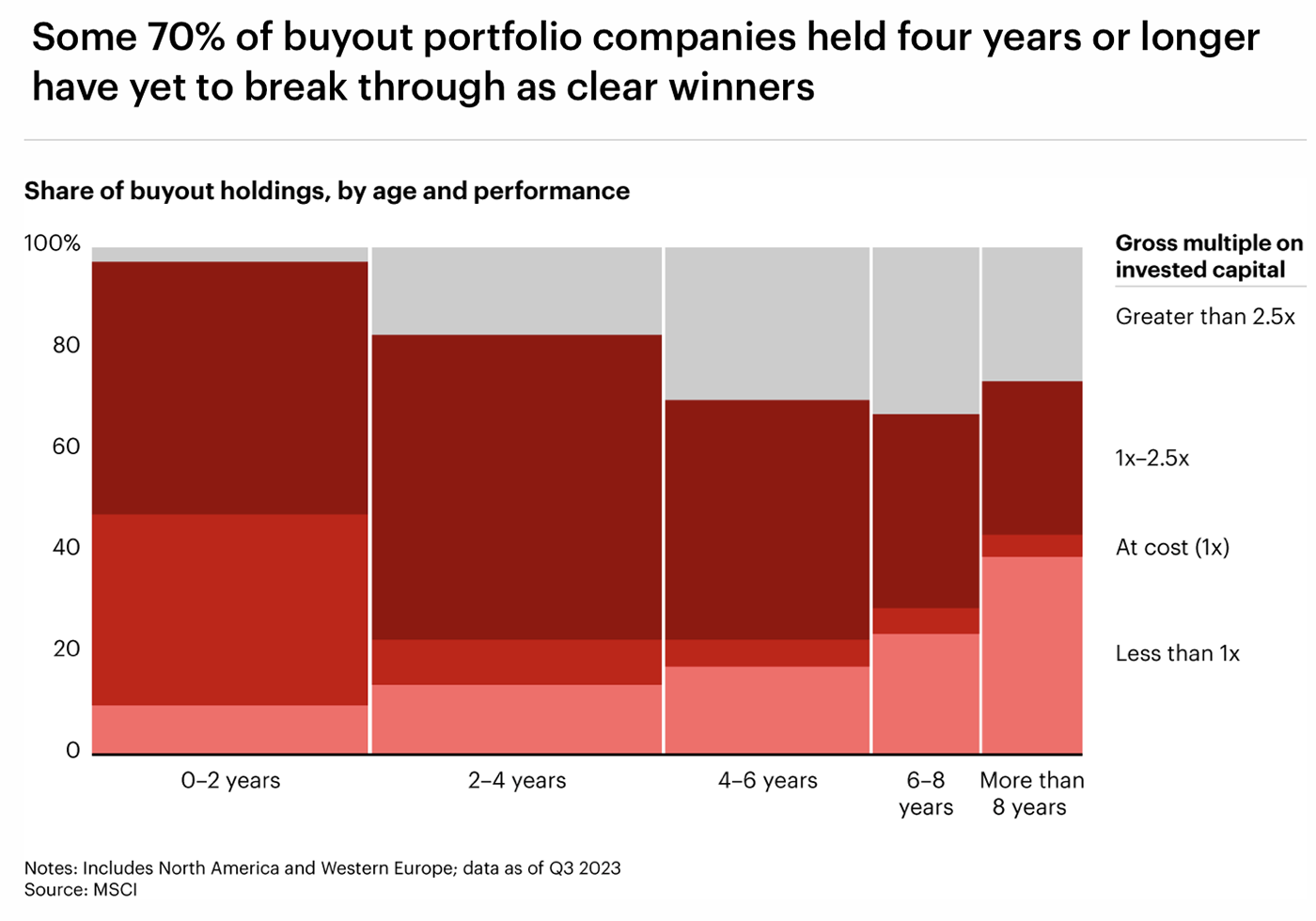

But now, 36% of companies held for six years or longer are now just at breakeven or below… with some barely breaking even.13

Furthermore, a staggering 70% of buyout portfolio companies held for four years or longer have yet to break even.14

The best-case scenario is that returns will be diminished going forward, possibly making it less attractive to endowments.

The worst-case scenario is a recession with no exit in sight, where private valuations drop to match lower public ones, and investors simultaneously demand their money back. This could lead to portfolio companies being sold at massive losses, resulting in the loss of hundreds of thousands, even millions, of jobs nationwide.

If things really start to break, it could trigger a cascade of effects across the financial system.

First, as private equity-owned businesses struggle and potentially default on loans, what would follow would be the credit crunch of the century.

If private credit funds can't meet their commitments, what would follow would be the credit crunch of the century.

There would be interbank lending seizures, a credit markets freeze, and short-term funding would dry up.

At the same time, the jobs of 11.7 million people would be in jeopardy.

For instance, In 2005, the mortgage industry employed around 535,000 people.

But after the crisis in late 2010, this number had plummeted to approximately 246,000… a 54% reduction in the mortgage workforce.

If private equity collapses to levels seen after the financial crisis, a potential 54% reduction in the industry would mean approximately 6.32 million jobs lost, which would be the equivalent of the entire population of Maryland.

The sudden surge in unemployment could send shockwaves through the markets and the economy, leading to reduced consumer spending, lower corporate earnings, and the potential collapse of the stock market.

And considering the US labor force typically consists of about 160–165 million people, that's nearly a 4% hit.

That is the worst-case scenario. Given the 10-year lockup on any given private equity fund, they may be able to earn their way out of it over time, but I am doubtful. Margin calls are rarely orderly.15

Chapter 2: Deals Vanish and Volume Declines

- Regional Decline

- Exit Decline

- The Impact of Record-Dry Powder

- PE Distribution Decline

- Capital for New Fundraising Declines

- And More

The recent (and rapid) rate hike cycle by the Fed in 2022 created a world of uncertainty for private equity. Private equity makes sense when rates are at zero and you can buy companies for 4X or 5X earnings, but when rates are at 5% and you're buying companies for 10X or 12X earnings, it's a problem.

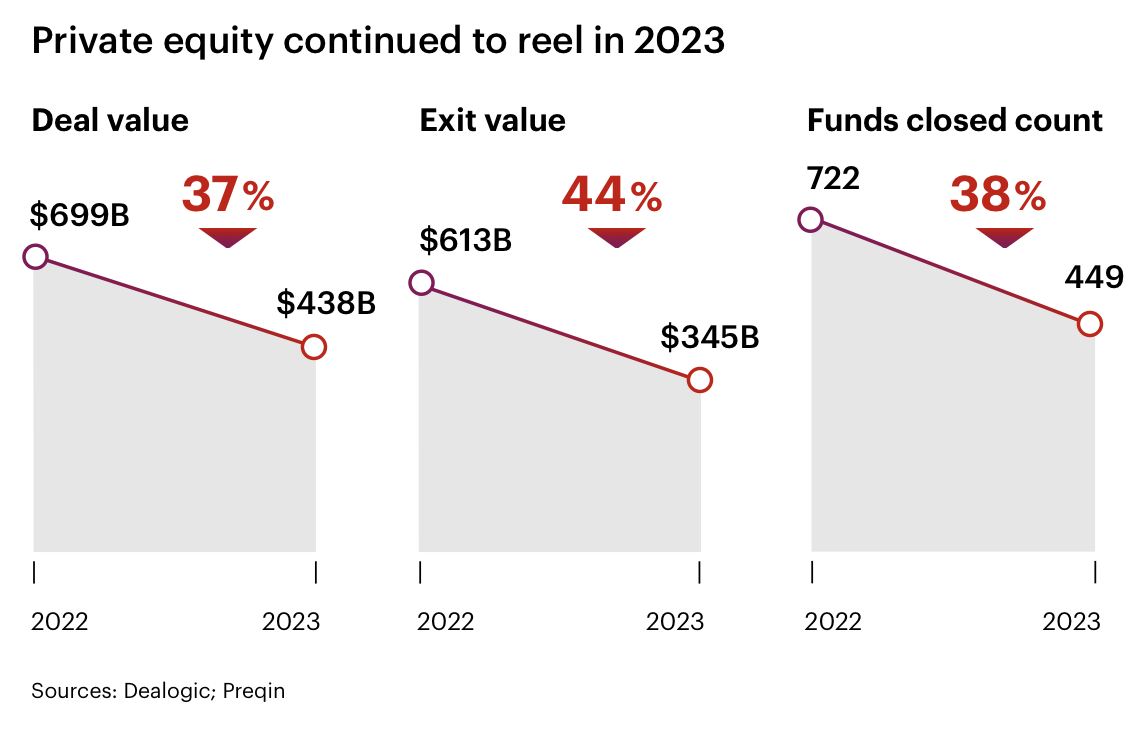

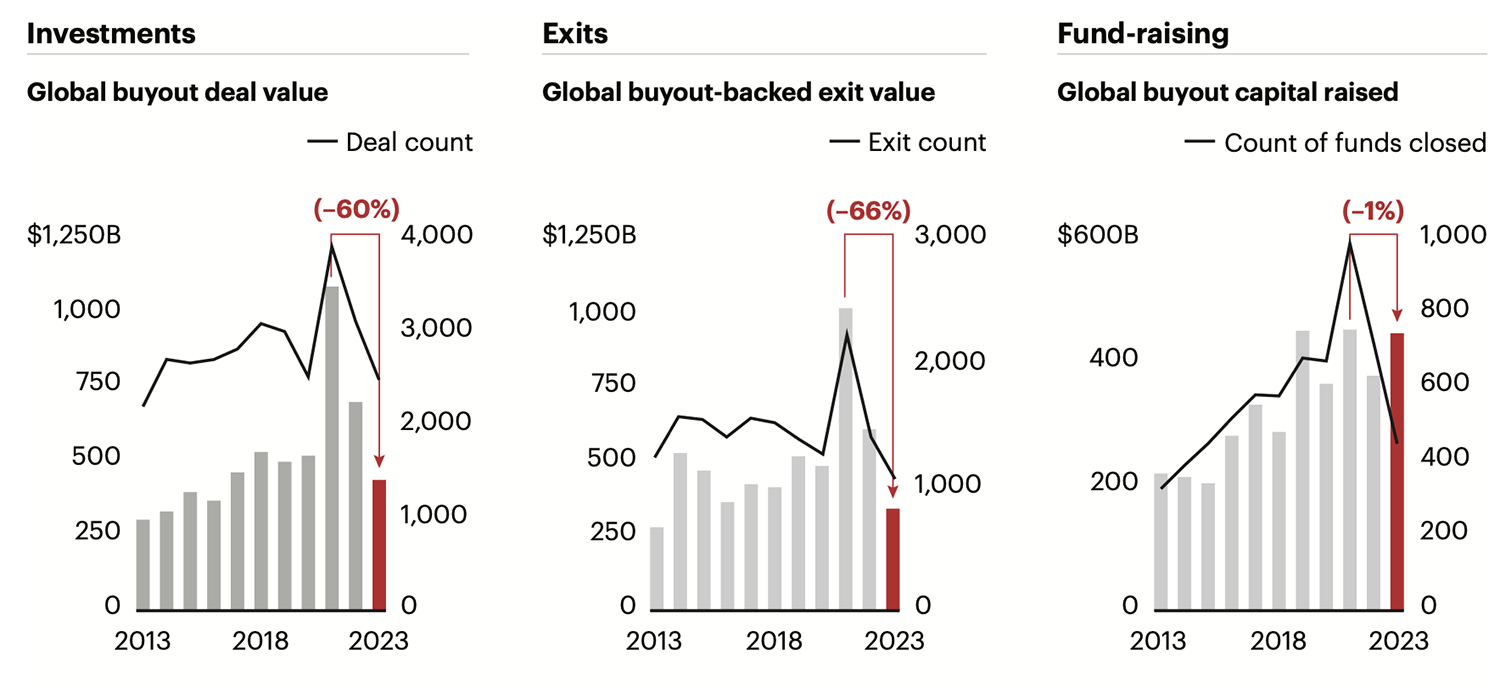

This uncertainty continued into 2023, causing a global slowdown of deal activity. Deal value and count fell by 60% and 35%, respectively, from their 2021 peaks.16

In 2023, deal volumes collapsed to 44% below 2022 numbers—the lowest levels in a decade.17

Fundraising also suffered due to 38% fewer buyout funds closing.18

Source: Dealogic; Preqin

Regional Decline

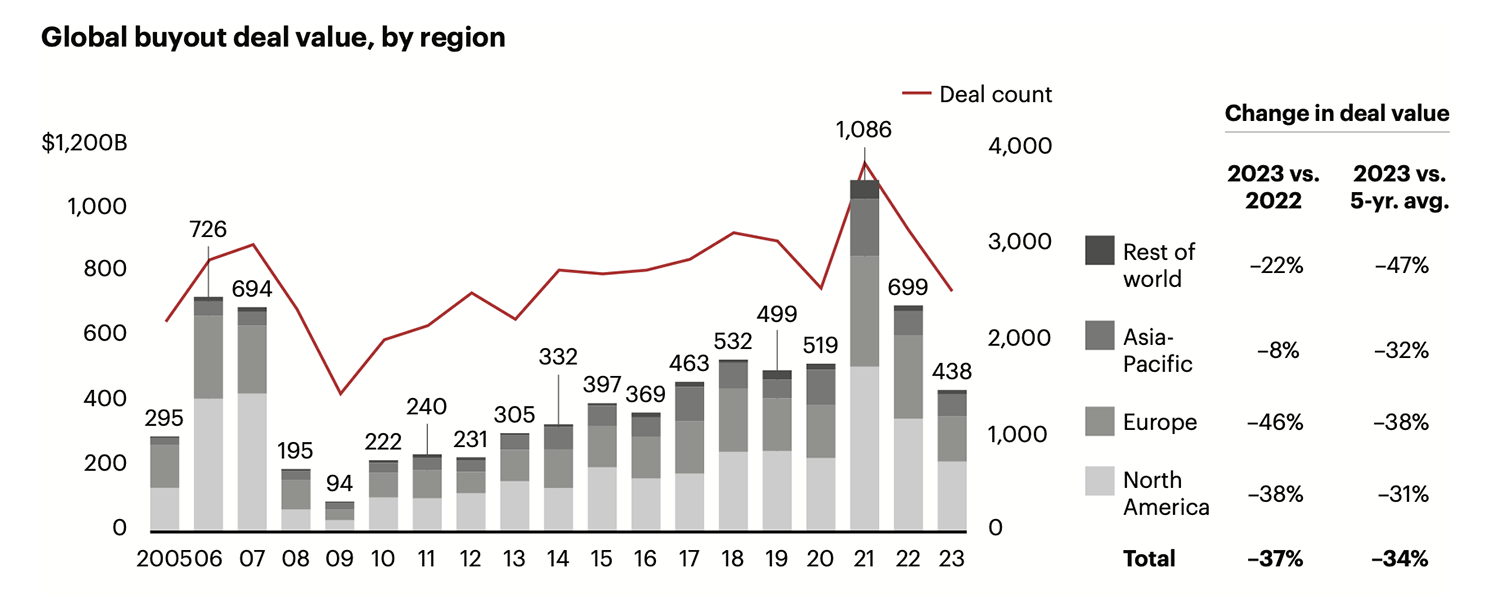

The impact was felt across regions: Buyout investment value plummeted to $438 billion, marking a 37% decrease from 2022 and the worst total since 2016.19 A lot of this was a function of high interest rates, but it was also a function of the size of the private equity industry. With so many competitors, there were few attractive candidates left.

Source: Dealogic

The overall global buyout deal count also fell by 20%, resulting in approximately 2,500 transactions.21

Exit Decline

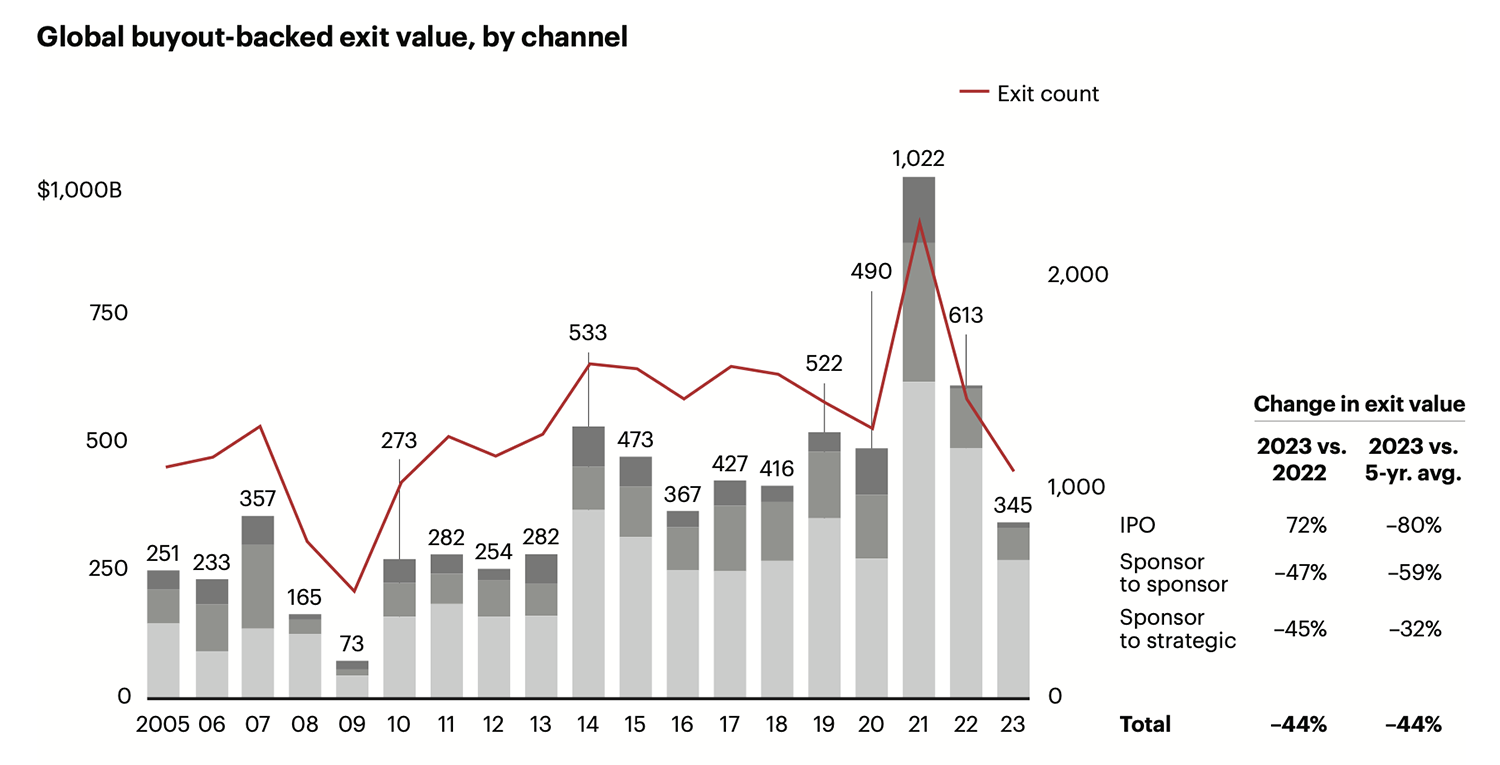

Exiting investments proved even more challenging.

The impact of rising interest rates, macroeconomic uncertainty, and valuation disagreements between buyers and sellers made exit activity performance even worse than dealmaking in 2023.

Buyout-backed exits totaled $345 billion globally, marking a 44% decrease from 2022.20

The total number of exit transactions also dropped by 24% to 1,067.21

One possible exit strategy is an IPO, but the market for IPOs hasn't been good, so it's said that the IPO window is "closing." PE firms are now relying on corporate acquisitions for exits. It's difficult to get acquired when the private valuations are so high.

Corporate buyers continued to dominate as the largest exit channel, making up nearly 80% of total exit value in 2023.

However, the value of these strategic deals dropped by 45% from 2022, declining to $271 billion.22

Source: Bain & Company

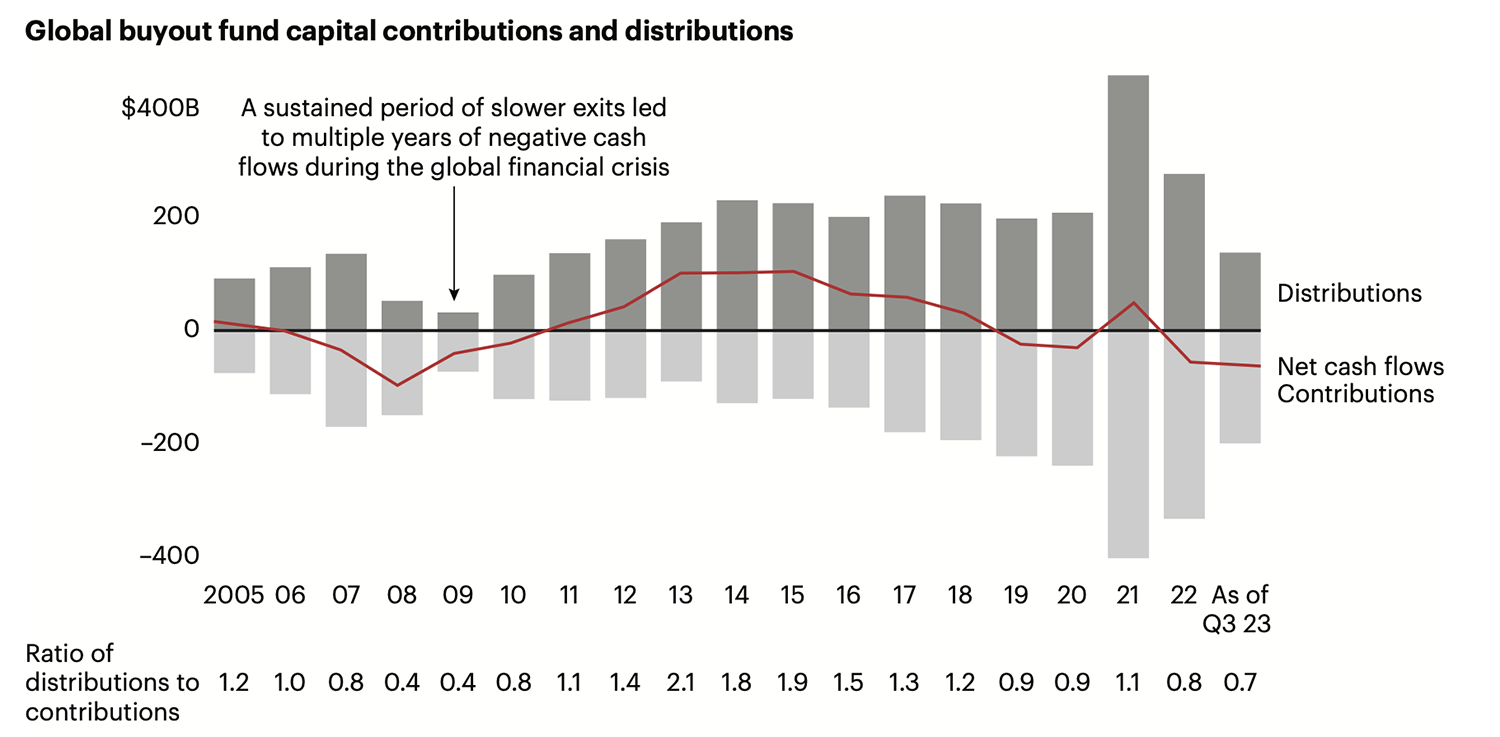

Limited partners have experienced negative cash flow for four out of the last five years, as unexited assets have accumulated and distributions to paid-in capital (DPI) have lagged.23

Source: Bain & Company

The Impact of Record-Dry Powder

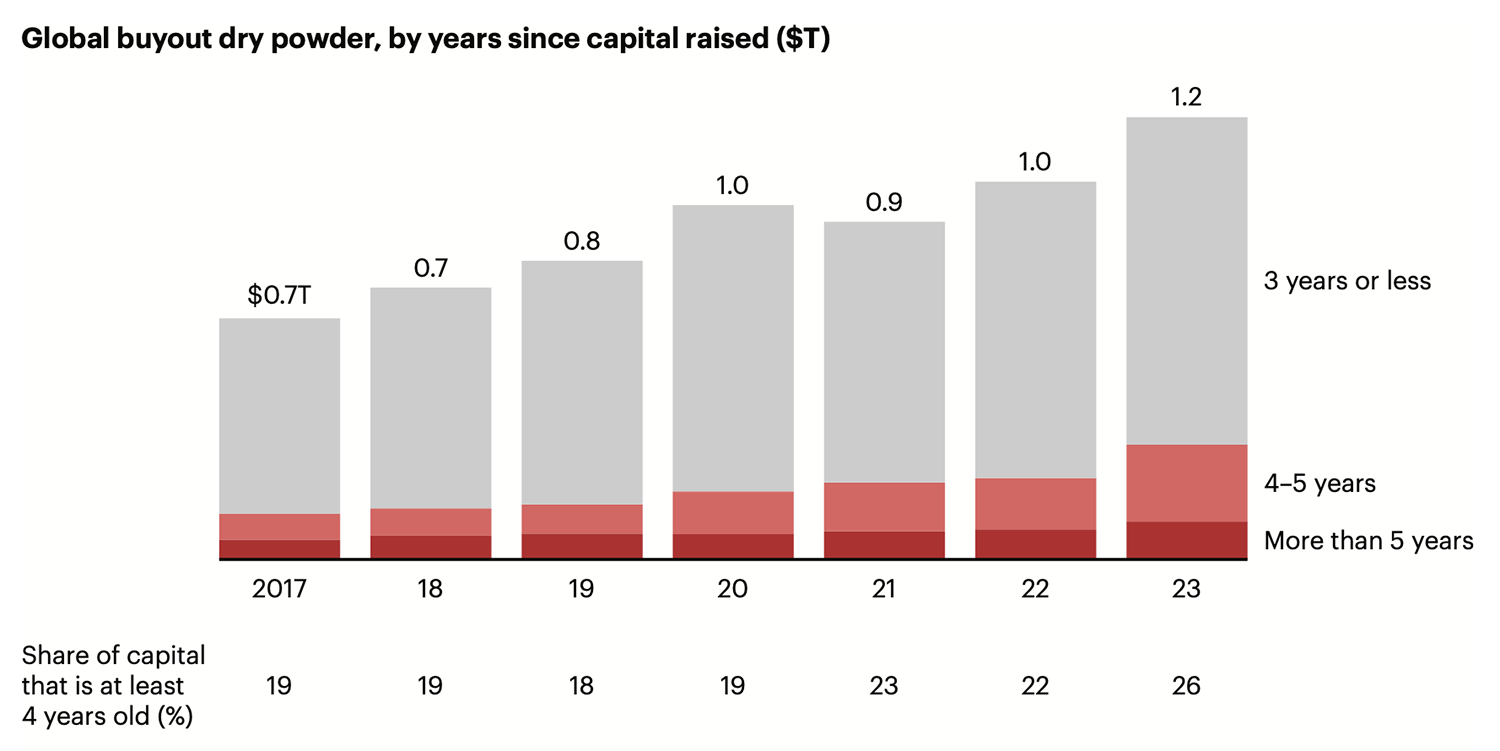

Another pressing issue is the surging accumulation of unspent capital, or dry powder, indicating hesitancy among buyout funds to engage in new deals.

Right now, there's a record $1.2 trillion in dry powder sitting on the sidelines, with 26% of it four years old or older.24

Source: Preqin; Bain analysis

But that's not necessarily bad because having a significant amount of dry powder can be a good thing.

Ample dry powder gives private equity firms the flexibility to seize opportunities as well as protection against volatility.

But the real issue is in the underlying reasons for dry powder accumulation.

Does the current private equity climate really look like a place to deploy capital right now?

To make matters worse, the PE industry is facing additional challenges impacting dry powder in 2024...

New compliance requirements and increasing public scrutiny are set to complicate deal-making.

The US Federal Trade Commission's proposed changes to the Hart-Scott-Rodino Antitrust Improvements Act will trigger significant antitrust investigations for transactions over the reporting threshold, currently at $111.4 million.

In order for large mergers and acquisitions to happen, PE companies are required to fill out an HSR filing.

The problem is this amendment will increase the cost, preparation, and timing required for HSR filings, which could lead to delays and higher expenses for private equity firms looking to deploy their capital right away.

PE Distribution Decline

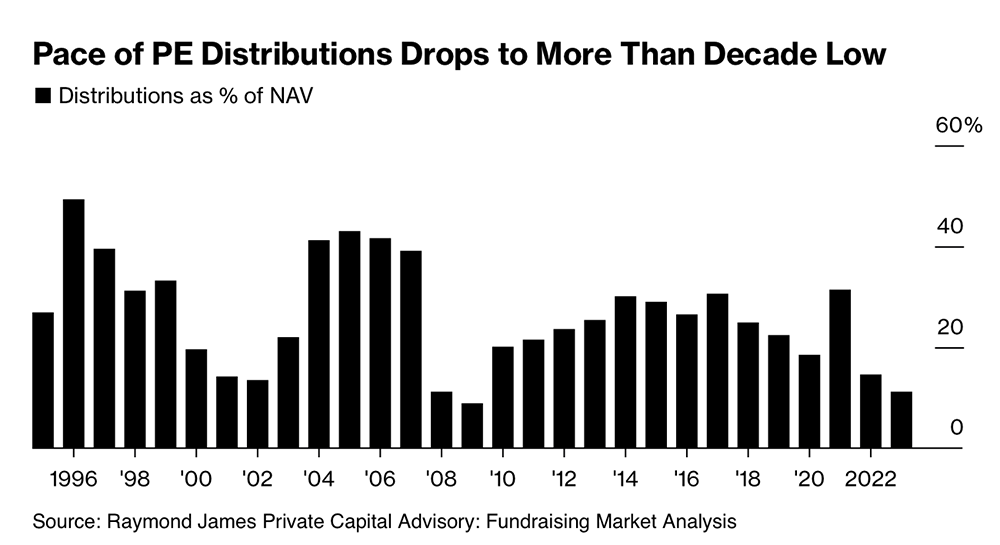

Adding to the woes, private equity funds returned the lowest amount of cash to investors in a single year since the Great Recession 15 years ago.25

Distributions to so-called limited partners totaled 11.2% of funds' net asset value, the lowest since 2009, and well below the 25% median figure across the last 25 years.26

This has caused the pace of distributions to drop to more than a decade low.

Volatile markets, economic uncertainty, and higher borrowing costs have combined to make it more difficult for PE firms to exit their investments.

The median holding period for a buyout firm asset sits at about 5.6 years, much higher than the industry norm of four years, according to the report.

"The cash flow math at the investor level is broken," Sunaina Sinha Haldea, global head of the Private Capital Advisory group at Raymond James, said in an interview. Because investors aren't getting money back from their existing holdings, the pressure on PE firms continues to mount.

Capital for New Fundraising Declines

Adding to these challenges, despite the industry's rapid growth over the years, available capital for new fundraising efforts has declined.

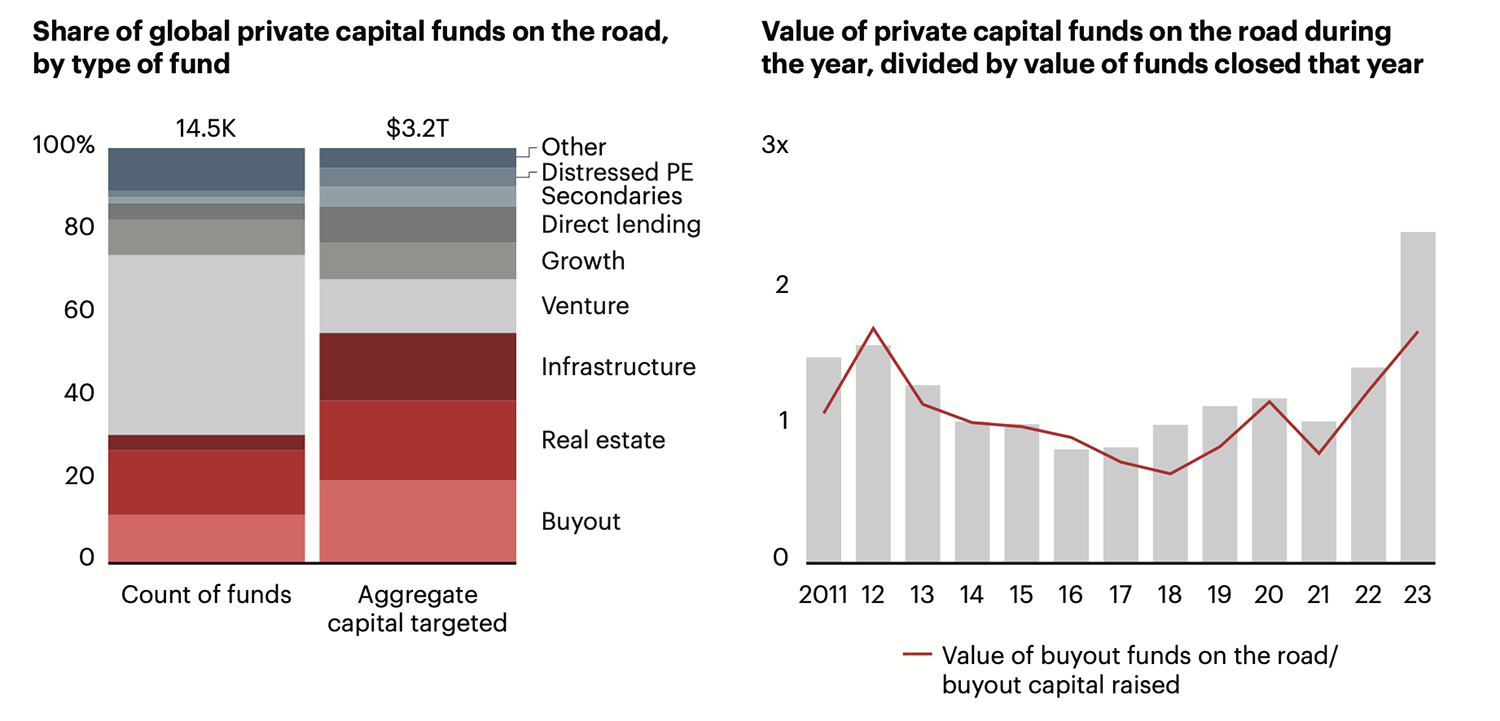

As of January 2024, around 14,500 funds were seeking $3.2 trillion in capital, but only $1 was closed for every $2.40 targeted.27

This is the worst supply/demand imbalance in over a decade, highlighting a significant issue in the industry's capital-raising efforts.

The figure of $3.2 trillion helps explain why secondary funds raised 92% more capital in 2023 than they did in 2022.

This amount represents the unrealized value of the 28,000 unsold companies weighing down buyout portfolios globally, with more than 40% of these companies being four years old or older.28

Moreover, a significant portion of the overall capital raised was concentrated among a handful of megafunds, with 50% of private equity capital raised in the US was attributed to only 17 funds.

Source: Bain & Company

Chapter 3: Cracks in the "Buzziest" Corner of Wall Street—Private Credit

- Loan Volume Decline

- Refinancing at Higher Rates

- Cost of Debt Increase

- The Rise of Dividend Recapitalizations

- The Pluralsight Deal: A Warning of Things to Come

- And More

Private credit has become the "buzziest corner of Wall Street,"29 experiencing massive growth since the 2008 Financial Crisis.

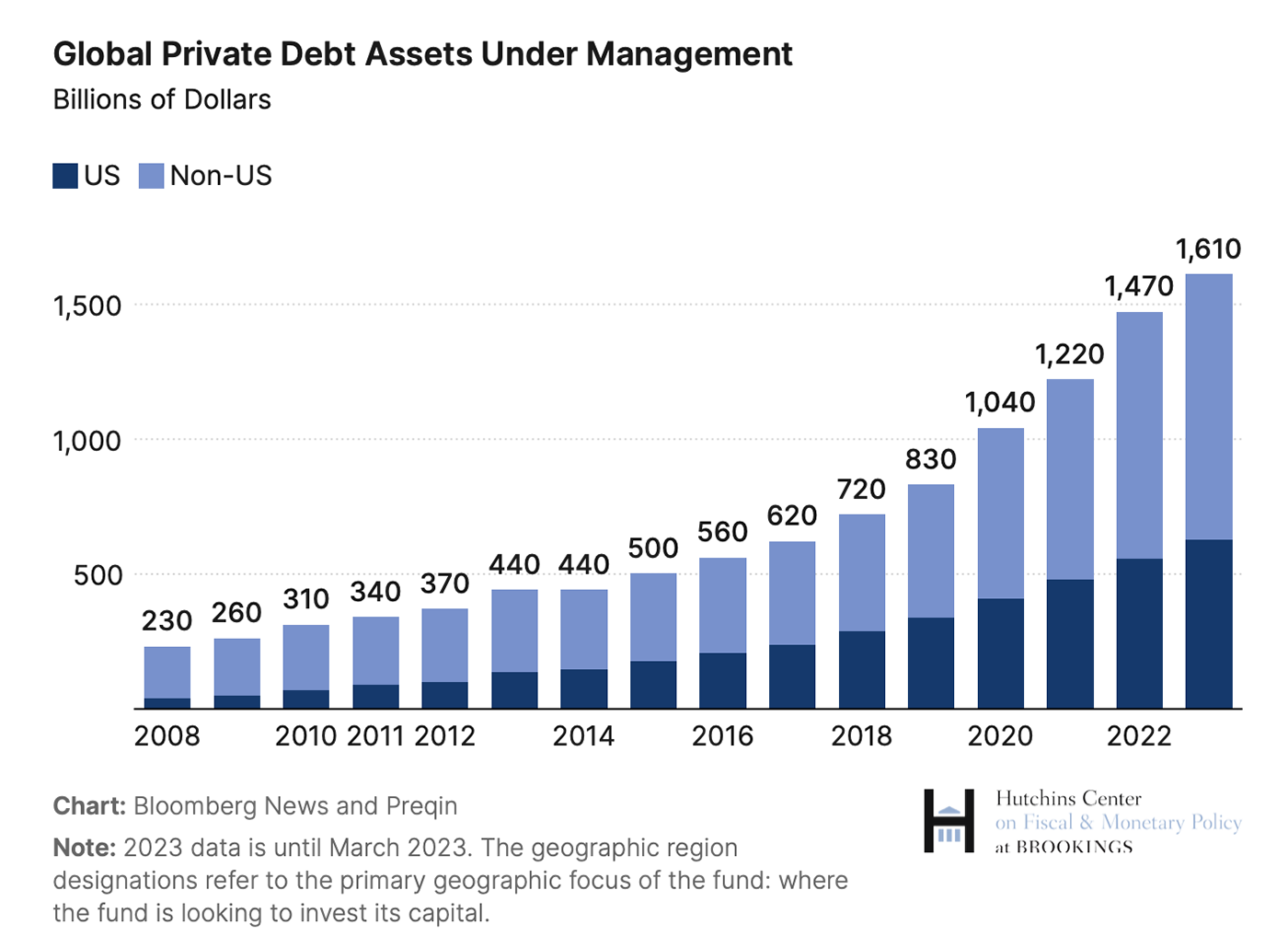

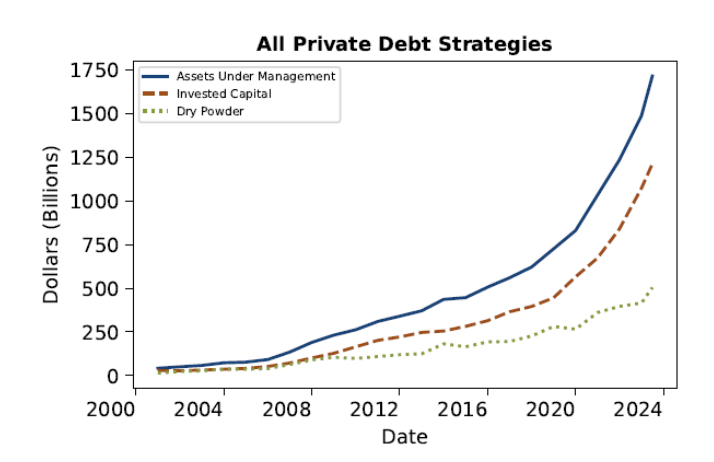

It's gone from approximately $375 billion in assets under management globally to over $1.6 trillion by March 2023, with BlackRock projecting it will exceed $3.5 trillion by 2028.30

Roughly 40% of private credit funds invest primarily in the US. The other big player is Europe.

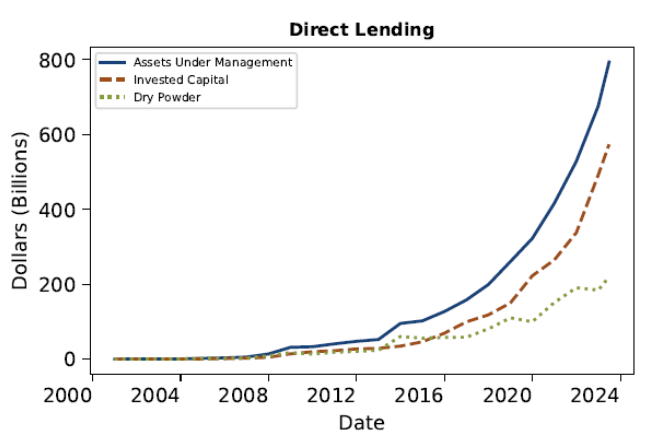

The most significant growth within private credit is in direct lending, which now totals $800 billion, or about half of the entire market.31

Source: Federal Reserve

Total private credit has grown exponentially in recent years, reaching nearly $1.7 trillion, comparable to the leveraged loans market (roughly $1.4 trillion) and the high-yield (HY) bond market (about $1.3 trillion).

Source: Federal Reserve

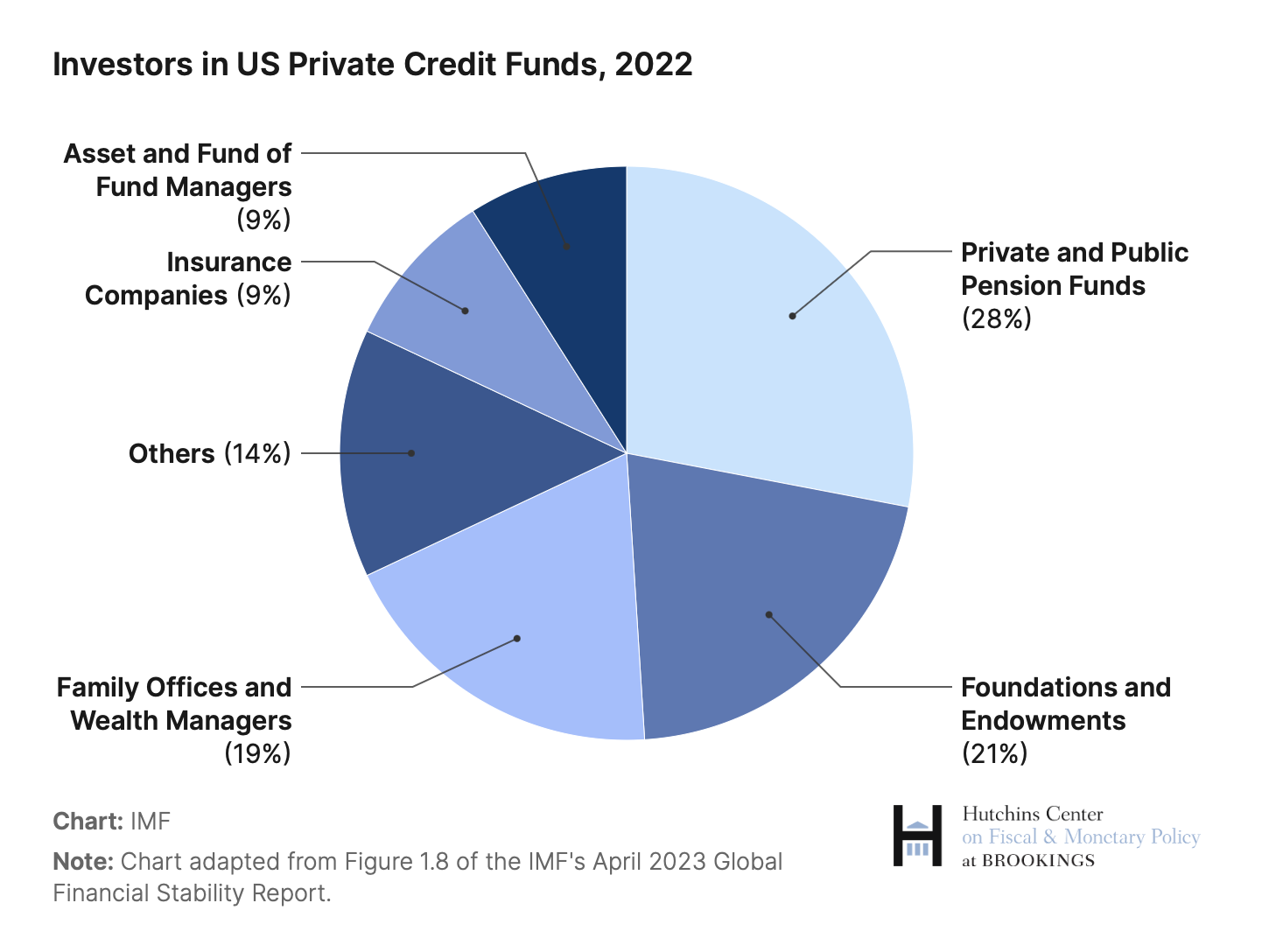

The largest investors, or limited partners (LPs), in private credit funds are pension funds, insurance companies, family offices, sovereign wealth funds, and high-net-worth individuals.32

The market has attracted major investors such as pension funds, insurance companies, family offices, sovereign wealth funds, and high-net-worth individuals, drawn by the higher yields that other fixed-income assets can't match.

However, cracks are beginning to show in this once-thriving sector. And Jamie Dimon warned "there could be hell to pay" if private credit sours.33

Of course, this was days after Moody's published a warning that the private credit market is headed for a period of stress thanks to higher-for-longer interest rates.34

To make matters worse, the rating company is already seeing a decline in credit quality.

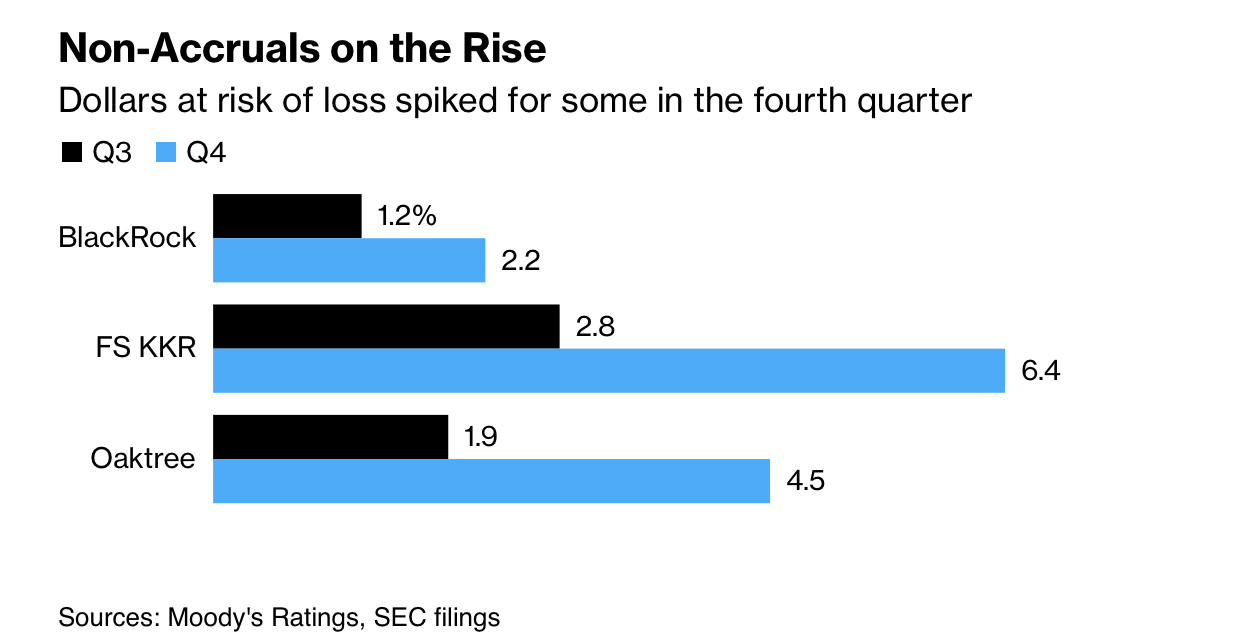

Moody's downgraded the credit outlook for BlackRock, KKR, FS Investments, and Oaktree Capital Management from stable to negative due to concerns about an increase in their loans that are either in default, close to default, or on nonaccrual status.

Sometimes referred to as doubtful loans, troubled loans, or sour loans, nonaccrual loans are loans that do not generate the expected interest payments because the borrowers fail to make their scheduled payments.35

While private credit loans generally have more flexible terms and conditions compared to traditional bank loans, the increase in nonaccrual loans is troubling.

Like the financial crisis where a surge in nonperforming loans led to significant financial distress for lenders, today's rise in nonaccrual loans threatens to destabilize lenders and reduce credit availability and sustainability.

Loan Volume Decline

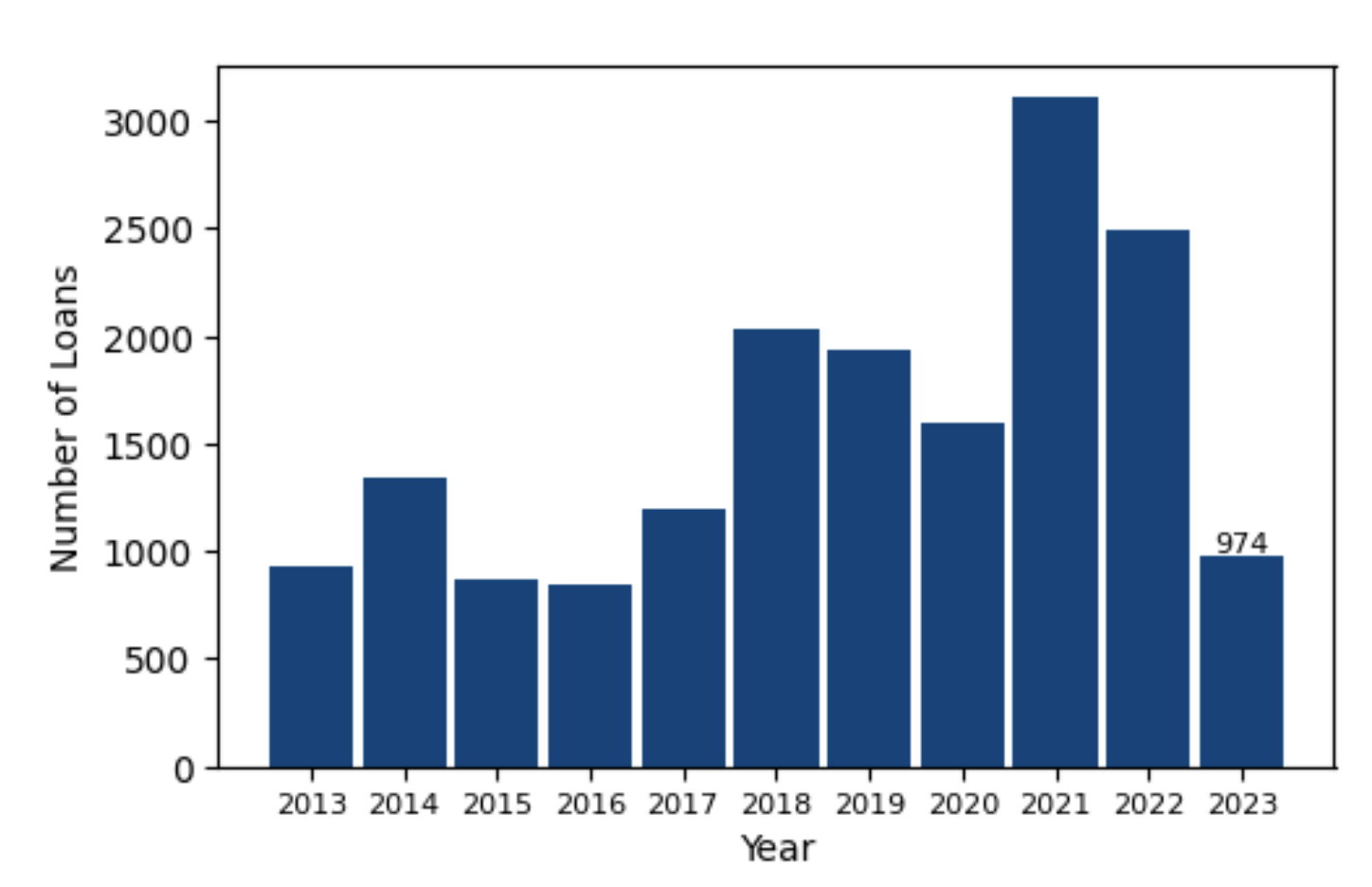

There has been a noticeable decline in the number of private credit loans over recent years, according to a sample of around 17,000 unique private credit loans originated by 718 private debt funds and BDCs.

While the average size of loans has increased, the total number of loans has decreased, indicating a trend toward fewer but larger loan deals in the market.

This trend could reflect several factors, including a declining market where private credit lenders are becoming more selective or lower demand due to higher interest rates, which makes borrowing more expensive.

As lenders focus on larger, potentially higher-risk deals, this shift may also signal a cautious approach in an uncertain economic environment.

The following chart shows the decline in the number of loans over recent years.

Source: Federal Reserve

Refinancing at Higher Rates

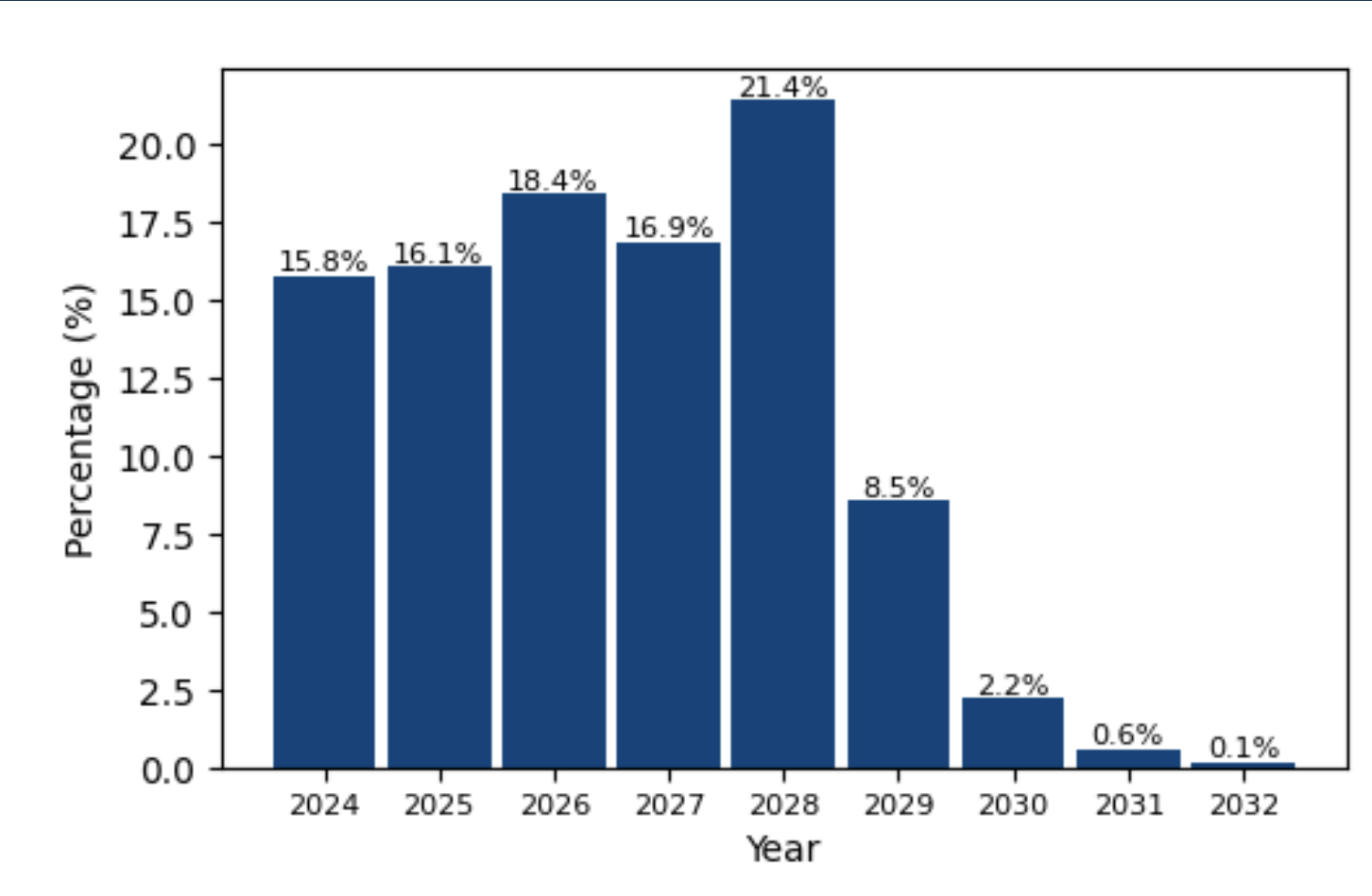

At some point, all this debt needs to be refinanced.

If market conditions are unfavorable, lenders downgrade, or borrowers default, and there's a risk of not meeting maturity deadlines.

That's what's concerning about 2028 when most of the debt will need refinancing within four years from now.

Source: Federal Reserve

The wall of maturing and concentrated debt poses significant risks for the private credit market.

Cost of Debt Increase

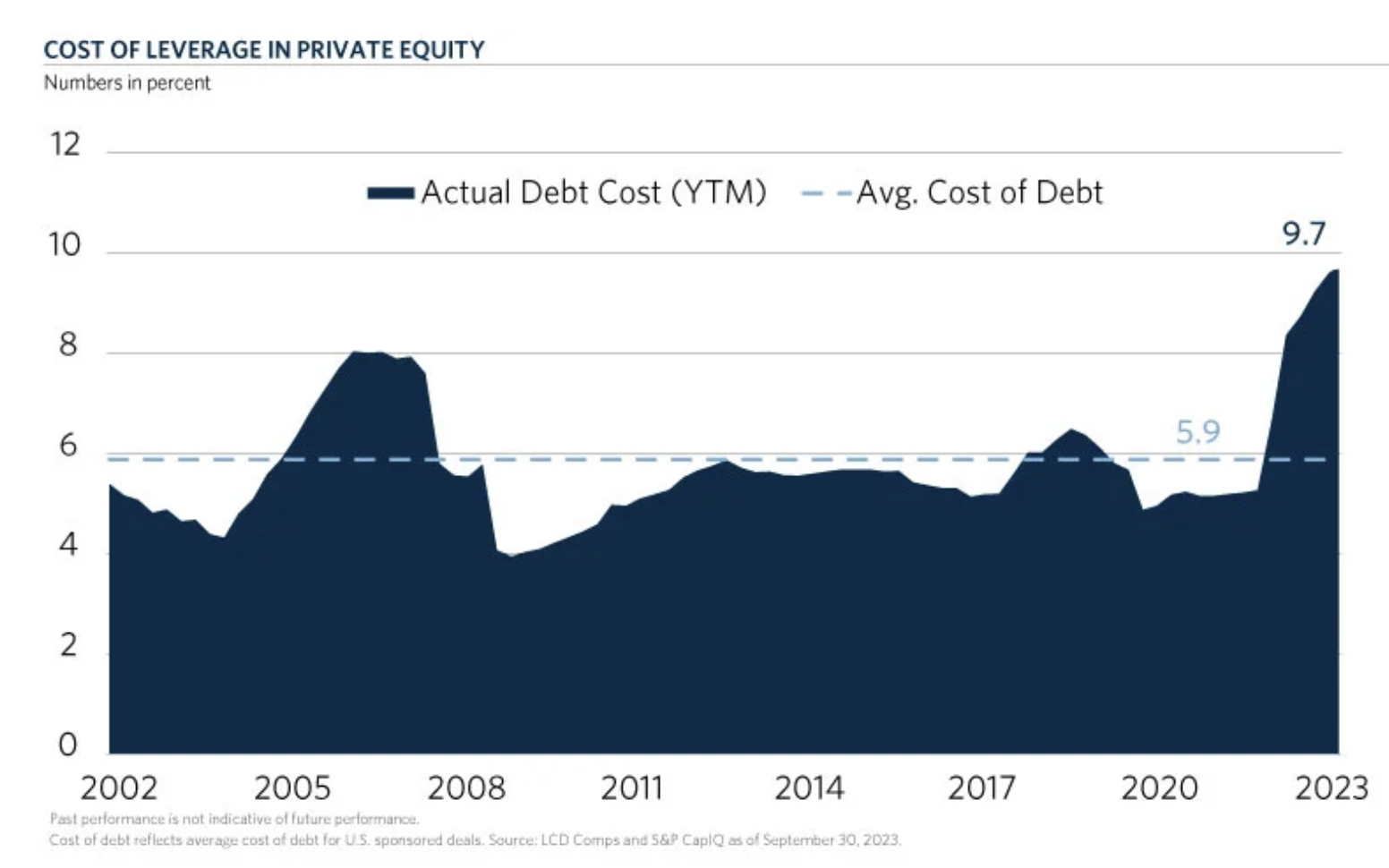

As deal-making volume has slowed and private credit has boomed, the cost of debt has risen while its availability has fallen.

PE firms, which have historically been overly reliant on leverage to finance transactions and create value, are now feeling the pressure as their portfolio companies struggle with higher interest costs.

Traditionally, PE fund managers have used leverage as a key tool for value creation, yielding positive outcomes when debt was virtually free.

However, buyers are now faced with a substantially increased cost of debt… currently about 380 basis points above the 20-year average in the US.36

The Rise of Dividend Recapitalizations

While private equity firms are struggling with rising debt costs and declining deal volumes, another highly utilized but risky financial engineering strategy is to add debt for quick cash.

Otherwise known as dividend recapitalizations, it's a process where a company incurs new debt in order to pay special dividends to private investors or shareholders.

While this method can generate returns for investors when traditional exits are not feasible, the risks in a high-interest-rate, low-deal, highly leveraged, and low-return environment are immense.

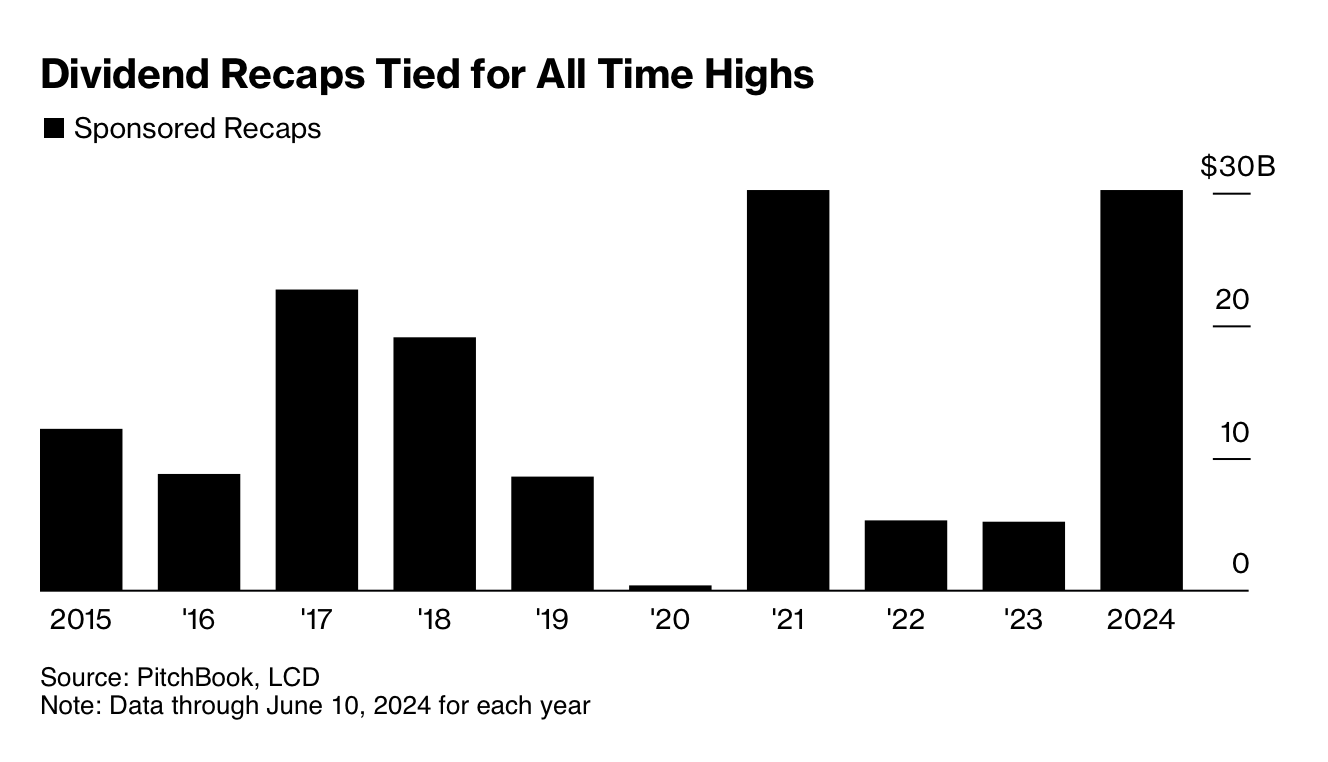

And in the first half of 2024, the frequency and amount of borrowing by companies skyrocketed.

Approximately $30.2 billion in leveraged loans have been issued for these payouts so far this year, matching the levels seen in 2021… the highest in at least a decade.

Managers of exclusive capital pools have long promised substantial and quick returns to their limited partners, such as endowments and insurers.

But due to the significant drought in the PE market, adding debt for quick cash has become an attractive alternative, with debt investors flush with cash eager to buy various credit products.

The problem is these "added debt for quick cash" opportunities burden portfolio companies… and that can lead to bankruptcies or worse.

For example, in 2019, Staples was saddled with an additional $3.2 billion in debt to fund a $1 billion dividend payment to its private equity owners, Sycamore Partners.37

Source: bestlifeonline.com 38

Payless ShoeSource filed for bankruptcy after dividend recapitalizations in 2012 totaling approximately $350 million.

Source: cnn.com

Healthcare industries are also racked with debt.

PE-backed healthcare companies averaged a debt-to-EBITDA ratio of 5.9X in 2023, compared to around 3X for publicly traded companies.39

As of November 2023, healthcare bankruptcies reached a five-year high; all but three of the 45 most distressed healthcare companies were owned by PE firms.40

Despite their size and influence, KKR saw two of its healthcare investments—Envision Healthcare and GenesisCare—file for bankruptcy in 2023. 41

Don't be surprised by another wave of private equity-backed bankruptcies this year.

The Pluralsight Deal: A Warning of Things to Come

With excess debt and leverage, private credit firms are now unwilling to come to terms on how to value the debt.

In 2021, the education platform Pluralsight was acquired for about $3.5 billion by PE firm Vista Equity Partners.

The acquisition was financed using a "recurring revenue" loan, which allowed for high leverage at a time when interest rates were near zero.

But soon after the acquisition, Pluralsight encountered financial challenges, like rising interest rates and industry-specific issues, so Vista attempted to restructure the company's debt.

The restructuring included a controversial maneuver known as a "drop-down," where Vista moved Pluralsight's intellectual property to a foreign subsidiary. The goal was to raise $50 million to cover an upcoming interest payment.

It worked…

Except it reduced the value of the collateral backing the loans provided by the private credit firms that had extended the original loan.

This caused serious tensions between Vista and the private credit lenders.

As the lenders' collateral declined, the risk associated with their loans increased, highlighting the inherent risks and conflicts within the private credit market.

Today, the lenders are likely to take over Pluralsight as they try to recover the money they loaned.

However, the issue—and how it relates to private equity—arises when lenders can't agree on how to value the company's $1.7 billion debt

The debt was marked down to 84.9 cents and 83.5 cents on the dollar by private credit funds Ares and Blue Owl.

Other private credit funds Golub, Benefit Street Partners, BlackRock, Goldman Sachs, and Oaktree marked the loan at about 97 cents on the dollar.42

Given the size of the loan, this discrepancy amounts to over a hundred million dollars.

Five big-time private credit firms marked the debt at different values, leaving creditors and investors in a precarious spot.

Vista Equity is expected to write down Pluralsight's valuation to zero by the end of 2024 and walk away.

The broader concern is what will happen between now and 2028, as $3.2 trillion in debt across 28,000 private equity-owned companies will need refinancing when five of the largest creditors can't agree on a single loan restructuring.

Without refinancing, many of these companies could default on their debt obligations, leading private equity firms to follow Vista's example and walk away.

If a significant number of private credit loans default or are marked down, it could spark a broader crisis.

Bottom line: The inability to refinance $3.2 trillion of debt could trigger an unprecedented liquidity crisis, drowning the private equity and private credit markets in a sea of bankruptcies.

These issues could spill over into the broader financial markets, with large-scale defaults and bankruptcies shaking investor confidence.

The only ones not at risk for a broad market private credit collapse would be private equity companies who escape in time.

Chapter 4: Is America's Retirement Dependent on Private Equity's Success?

- Funds Lock Up

- State Pension Plans

- And More

US companies and state and local governments oversee approximately $5 trillion in pension funds.

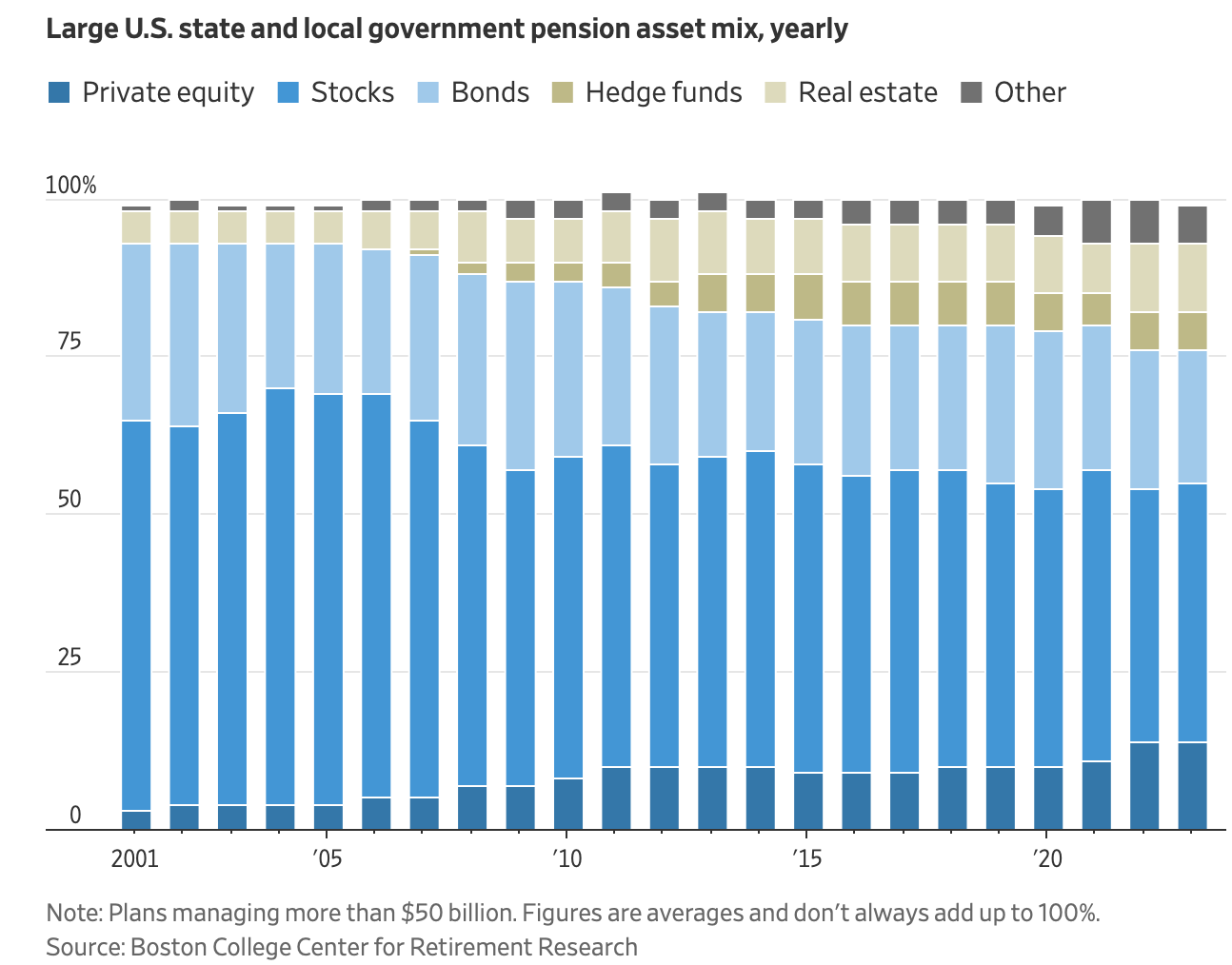

On average, large public pension funds allocate 14% of their assets to private equity, whereas large corporate pensions invest nearly 13% in private equity and other illiquid assets like private loans and infrastructure.

Pensions, sovereign wealth funds, university endowments, and other institutions often promise their money to private equity managers for a decade or so.

During that time, managers draw down the cash and use it to buy companies that they overhaul and sell.

By now, it should come as no surprise that those sales and the resulting cash distributions to investors have slowed for all the reasons discussed in this white paper.43

A more troubling development is that a Coller Capital survey found that almost half of private equity investors had money tied up in so-called zombie funds, or private equity funds that fail to make payments on time, leaving investors in limbo.

To keep retiree benefit checks on schedule, investment managers are being forced to liquidate assets at a discount or resort to borrowing, which incurs additional costs and further erodes returns.

A good example is the California's worker pension—the largest in the nation— thanks to its private equity investments, is expected to spend more than it earns from them for the next eight years.

While spending more on its private equity portfolio might seem counterintuitive, it highlights a broader issue: Private equity investments often appear more attractive on paper because of how they account for profits and losses. The promise of high returns over the long term can overshadow short-term liquidity concerns.

Allen Waldrop, private equity director at Alaska Permanent Fund Corp, said, "You've got a lot more money out and going out than is coming back."44

This situation is exacerbated by the fact that many of these investments are tied up in hard-to-sell assets, creating a cash crunch for pensions that need to ensure retirees receive their benefit checks on time.

Which then contributes to the landscape of private equity firms and pension funds undergoing significant cultural changes right now.

At least if money is tied up with PE funds, there's a chance of beating the S&P 500, right?

Wrong. Over a 10-year period, investors paid $230 billion in performance fees for returns that were at par with the S&P 500.45 46

PE funds couldn't even beat the market for their investors, yet they continued to rake in billions in fees.

The number of private equity barons with personal fortunes exceeding $2 billion has risen from three in 2005 to 22.47

Despite creating multibillionaires, the average performance of these funds has not significantly outperformed basic US index funds since 2006.48

Funds Lock Up

Backers of PE are now demanding more control over their investments.

A growing number of investors are setting new conditions for their commitments to the world's largest private equity firms.

Specifically, they're insisting that their capital tied up in old funds be released before they commit to new fund raises.

Additionally, these investors are requesting fee discounts, more co-investment opportunities, greater information rights, and representation on committees.

Some are even negotiating for a share of the fund's management fee or the opportunity to buy a stake in the fund manager.

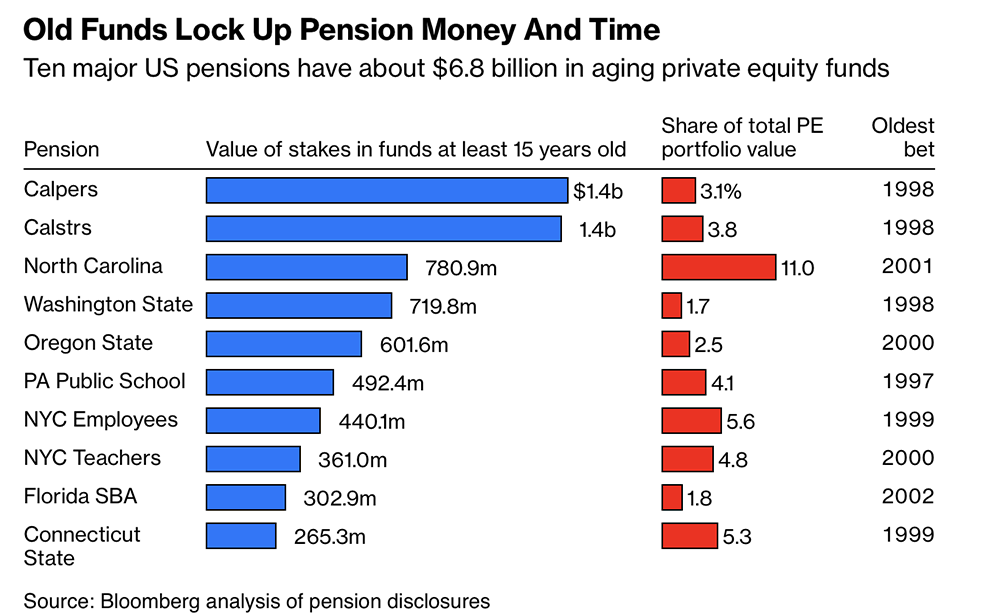

Take a look at old funds locked up in pensions.

After years of ramping up allocations that helped launch numerous private equity firms, many pensions have maxed out how much they can devote to private equity (sometimes referred to as the "illiquid asset class").

The problem is after years of increasing allocations to private equity, many pension funds have reached the limit of what they can invest.

And in a high-interest rate environment, funds are now redirecting cash elsewhere.

While on the surface the percentages might not immediately raise alarm, consider this: During the 2008 financial crisis, exposure to mortgage-backed securities (MBS) was a major factor in the systemic collapse.

The current exposure of pensions to aging private equity funds—ranging from 1.7% to 11%—may seem modest, but the illiquidity and underperformance of these assets present significant risks.

For instance, North Carolina has 11% of its PE portfolio tied up in funds that are at least 15 years old.

This means that these funds cannot easily be reallocated or liquidated to meet other financial obligations, creating a vulnerability we haven't seen since mortgage-backed securities during the financial crisis.

How? The stress these aging private equity assets place on pension funds could have far-reaching implications, potentially leading to a credit crunch or broader financial instability.

If pension funds need to liquidate these positions at a discount or struggle to meet their commitments due to asset illiquidity, it could trigger a broader sell-off, leading to a significant market correction or recession.

State Pension Plans

Bloomberg reports that across the nation, public pension funds are stuck with private equity holdings that "keep plodding on year after year."49

Given these risks, it's no surprise that pension funds across the US are making significant moves.

The Teachers Retirement System of Texas, which manages $202 billion in assets, is reallocating nearly $10 billion away from private equity investments.

This move reduces their target allocation from 14% to 12%, which is below the US public pension average of 13%.

A representative sent us correspondence about the matter and said that it'll take several years but the "trustees are set to formally adopt it into investment policy at the September meeting."50

The decision, influenced by dwindling returns and a slowdown in portfolio company exits, reflects broader concerns within the industry about future performance.

But Texas Teachers isn't the only pension fund steering away from PE.

In 2022, the Alaska Permanent Fund, which oversees the state's $80 billion sovereign wealth fund, started cutting back on its private equity commitments and subsequently lowered its target allocation from 19% to 15% the following year.51

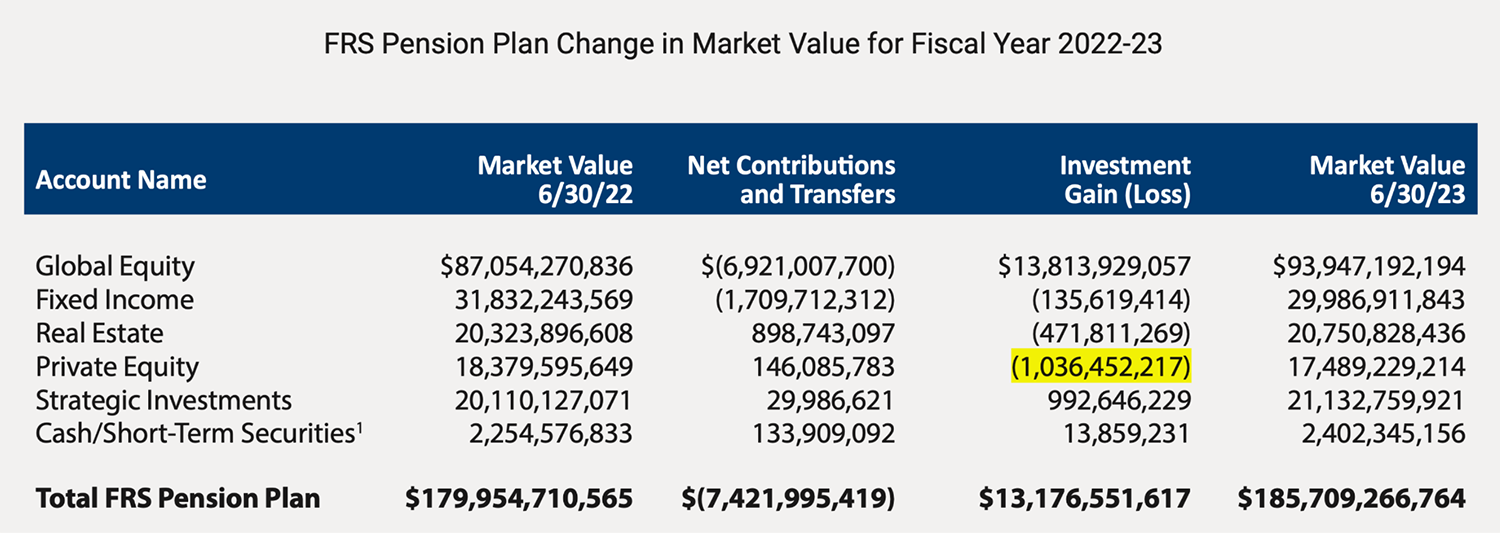

Another pension fund that avoided making headlines is the Florida Retirement System's pension plan.

In fiscal year '22–'23, private equity was the worst-performing asset class, which cost Florida retirees over a billion dollars.52

Source: SBAFLA.com

Chapter 5: Sentiment Extremes

- Celebrity Endorsements and Media Hype

- Media Coverage

- Sports Stars Entering Private Equity

- Educational Programs

- The Peak of Sentiment

- And More

If you've been following me for any time, you know my investment strategy doesn't rely on fundamentals or technicals… it's based on sentiment.

By grasping the overall mood of the market, sector, investor attitudes (or all of the above)... I then use this information to anticipate the next big move.

When the market swings too far in either a bullish or bearish direction it'll snap back the other way like a rubber band.

Naturally, sentiment follows price.

When sentiment in an industry reaches fever pitch, it's often a sign of a peak.

And the sentiment around private equity is off the charts.

Celebrity Endorsements and Media Hype

Historically, when celebrities start investing in a sector, it often indicates the peak of market sentiment.

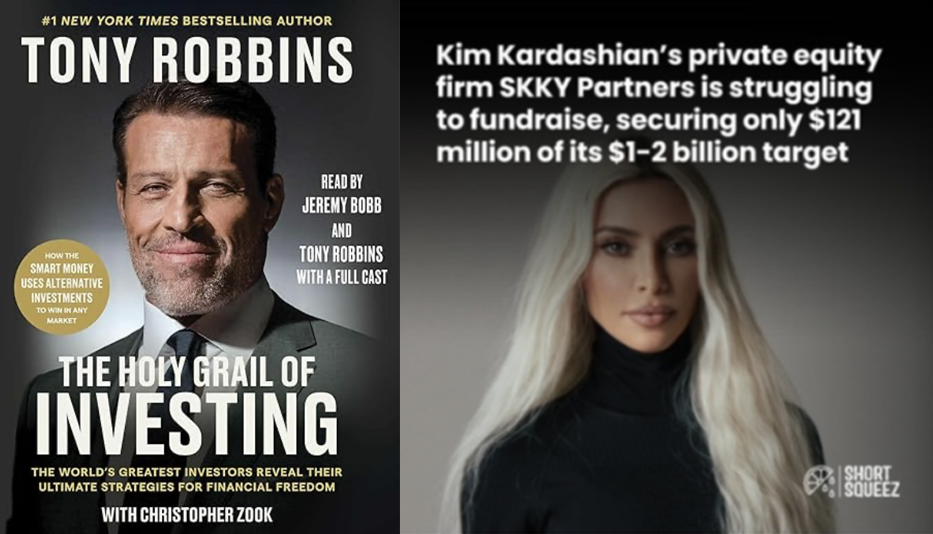

Tony Robbins, Kim Kardashian, Serena Williams, and Jay-Z,53 have jumped into private equity.

It would have made more sense to do it 10 years ago, so you have to ask, what's going on?

Unsurprisingly, Kim Kardashian's PE firm, SKKY Partners, is struggling to raise funds, and secured only $121 million of her $1–$2 billion target.

Tony Robbins recently released his book The Holy Grail of Investing... and it's all about, you guessed it, private equity.

Do the contents of this white paper feel like PE is the "Holy Grail?"

Media Coverage

Cover stories of major financial magazines often serve as contrarian indicators for market sentiment.

Take a look at the recent Forbes cover featuring Blackstone's Jon Gray.

Forbes could have run this cover at any point in the last 15 years, but it chose to do it now.

The article inside is titled "Blackstone's $80 Trillion Opportunity" and on the cover is the phrase "Remastering the Universe.54

This kind of coverage is often a sign that a market or sector is overheating.

Sports Stars Entering Private Equity

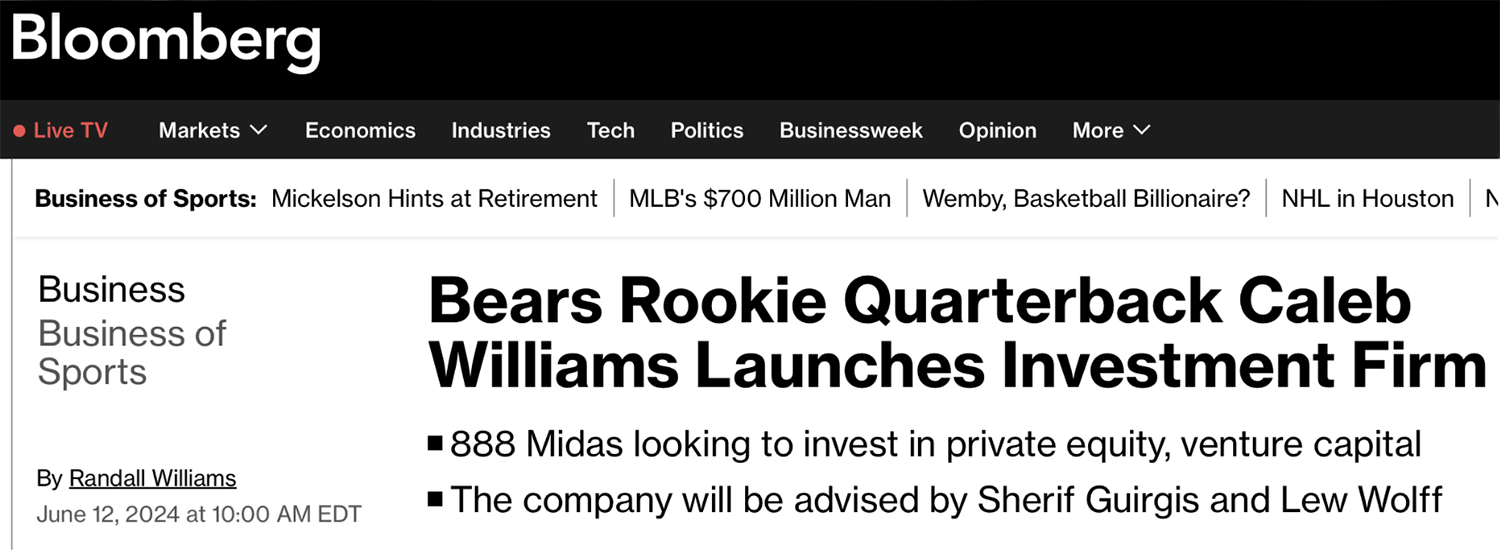

Chicago Bears rookie quarterback Caleb Williams launched an investment firm targeting private equity, venture capital, and real estate deals.55

He named it "888 Midas."56

Are you getting the picture yet?

Educational Programs

Breaking news: Anyone can become a "master of the universe" because Wharton now offers a private equity certificate program.

Apparently, in just eight weeks, you can do a self-paced online course and "gain the skillset of an early- to mid-level private equity professional."

Bottom line: When everyone wants in on a perceived lucrative opportunity, it's often a sign of market saturation.

Here's what first caught my eye about PE being an overheated sector: Last December, Blackstone made a music video—no kidding—about how awesome they are.

You can find it on my X timeline.

I don't think it was meant to be shared with the public, but it made the rounds.

The Peak of Sentiment

When everyone from celebrities to rookies in sports to prestigious educational institutions starts touting private equity, the market has definitely topped.

Conclusion:

The Unwinding of Private Equity—What's Next

As we’ve explored throughout this exposé, the parallels between today’s private equity market and the prelude to the 2008 mortgage crisis are undeniable.

The explosive growth, financial engineering, and unsustainable leverage are all signs of a market nearing its peak—deals are drying up, sentiment is reaching extremes, and even the “buzziest” sectors, like private credit, are showing cracks under pressure.

Pension funds, once thought to be safe, are now teetering on the edge—much like what we witnessed days before the last great financial collapse.

The writing is on the wall: Private equity is approaching a critical turning point.

But for those who prepare now, the rewards could be extraordinary.

History shows that the biggest opportunities often require patience, discipline, and the courage to act early—long before the crowd catches on.

Think of those who positioned themselves ahead of the housing collapse: They endured doubt, criticism, and challenges, but the payoff was life-changing.

About the Author

Jared Dillian is one of the most original and contrarian voices in the financial industry today. A former trader at Lehman Brothers, Jared was instrumental in growing the ETF trading desk’s top-line revenue from $32 million in 2004 to $82 million in 2008.

In 2008, he launched The Daily Dirtnap, a financial newsletter that has become a trusted resource for professional investors and market enthusiasts. Jared’s investment strategy is based on investor sentiment and behavioral finance. Daily Dirtnap readers receive Jared’s market commentary and trading ideas 225 times a year, three pages at a time. Interested investors should go here to learn more.

Jared is also the author of several acclaimed books, including Street Freak: Money and Madness at Lehman Brothers (Businessweek’s #1 general business book of 2011) and No Worries: How to Live a Stress-Free Financial Life. His writing has been featured in Bloomberg Opinion, Forbes, TheStreet.com, Reason Magazine, and more.

A graduate of the United States Coast Guard Academy (BS, Mathematics and Computer Science), Jared also holds an MBA from the University of San Francisco and an MFA from the Savannah College of Art and Design.

13 Block, J., Jang, Y.S., Kaplan, S., and Schulze, A., A Survey of Private Debt Funds, National Bureau of Economic Research (2023).

36 LCD Comps and S&P CapIQ as of September 30, 2023. Cost of debt reflects average cost of debt for U.S. sponsored deal s. https://www.federalreserve.gov/econres/notes/feds-notes/private-credit-characteristics-and-risks-20240223.html

39 https://www.healthcaredive.com/news/private-equity-stakeholder-project-healthcare-bankruptcy/713297/

40 https://www.healthcaredive.com/news/private-equity-stakeholder-project-healthcare-bankruptcy/713297/

41 https://www.healthcaredive.com/news/private-equity-stakeholder-project-healthcare-bankruptcy/713297/

50 Email from a private contact.

READ IMPORTANT DISCLOSURES HERE.

YOUR USE OF THESE MATERIALS IS SUBJECT TO

THE TERMS OF THESE DISCLOSURES.